Introduction

Have you ever wondered how you could better manage your daily finances without spending hours on it? With the advent of Fintech (Financial Technology), it has never been easier to take control of your money. These innovative platforms, accessible via mobile apps and online services, are transforming the way we manage our finances, making it more automated, personalized, and efficient.

The impact of this evolution is evident in the efforts that traditional banks are making to invest in and adapt to these emerging technologies. Fintech covers a wide range of services, from budgeting tools to investment platforms, automated payment and savings systems. However, to fully benefit from these platforms, it is essential to understand how to use them. In this article, we will explore the reasons why you should use Fintech to manage your money, the steps to get the most out of it, and practical tips for maximizing its use.

Why Use Fintech to Manage Your Money?

Fintech has become essential for financial management due to its innovative approach and ease of use. Here are some key reasons why using Fintech can benefit you:

- Accessibility and simplicity: You can now manage your finances via mobile apps or online platforms, eliminating the need for physical bank branches. Financial services are moving from traditional banks to specialized and innovative platforms.

- Security and transparency: Fintech platforms often use cutting-edge security technologies such as encryption, two-factor authentication, and strict adherence to banking regulations. Unlike some traditional banks, Fintechs are often very transparent about their fees, allowing users to know exactly what they are paying.

- Personalization and analysis: Fintech often provides personalized tools for analyzing spending, income, and investments, giving users a clear overview of their financial health. You become your own account manager.

- Cost savings: Many Fintechs offer services with significantly lower fees than traditional banks, especially for international transfers or foreign exchange payments. Some Fintechs even offer currency conversions at much more competitive rates than traditional banks.

- Smart notifications: Some Fintechs use artificial intelligence to provide personalized recommendations based on the user’s spending habits and financial goals. Users can also receive alerts when they approach a budget limit or when a significant expense has been made, promoting better control.

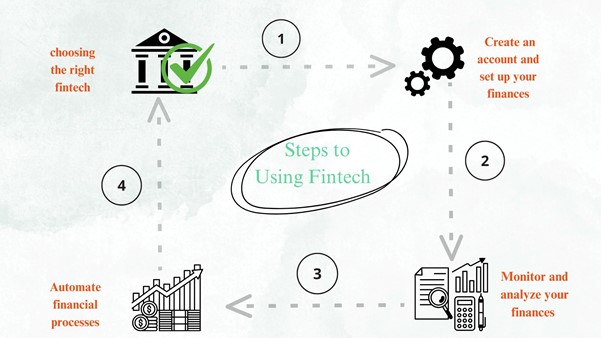

Steps to Effectively Use Fintech to manage your money

To get the most out of Fintech, it’s important to understand how they work and use them wisely. Here are the key steps:

- Choose the right Fintech for your needs: First, determine and assess your specific needs. Then, research and compare available options, considering features, fees, and security. Some apps are better suited for budgeting, while others specialize in investing.

- Create an account and configure your finances: Create an account on the selected platform and activate two-factor authentication for added security. Then, sync your bank accounts and credit cards to get a complete view of your finances.

- Track and analyze your finances: Use the tracking tools provided by the Fintech to analyze your monthly expenses. Set savings goals and monitor your investments. Most Fintechs offer intuitive dashboards to visualize your financial situation in real time.

- Automate financial processes: Take advantage of automation features to schedule automatic transfers to your savings or investment accounts. Also, set up alerts to monitor suspicious transactions, upcoming bills, and deviations from your budget.

Tips for Maximizing Fintech Usage in money management

Once you have set up your Fintech, here are some tips to maximize its potential and optimize your money management:

- Set clear financial goals: To fully benefit from Fintech’s financial management tools, set measurable goals. This could be saving for a major purchase, paying off debt, or reaching a certain investment amount. Specific goals will help you better utilize your Fintech’s features.

- Optimize the use of analysis tools: Regularly review the monthly or weekly reports generated by your Fintech. By regularly consulting the generated reports, you can adjust your budget and identify savings or investment opportunities.

- Diversify your use: Don’t limit yourself to just one Fintech. Combine multiple platforms for comprehensive financial management. For example, use one app for budgeting, another for investing, and a third for tracking debts or loans.

- Stay informed about innovations: The Fintech sector is rapidly evolving. Stay updated on the latest innovations to continuously improve your financial management.

Conclusion

Fintech is revolutionizing the way we manage our money by offering more flexible, faster, and cheaper solutions than traditional banks. By choosing the right platform and using its features effectively, you can take control of your finances, achieve your financial goals, and build a more secure financial future.